Are Investor Relations Teams More Transparent in Annual Communications than Quarterly Earnings Calls?

The New York Times reported recently on Laurence Fink’s request that corporations shift their focus from quarterly earnings calls to more long term reporting. His rationale, in part, is that the frenzy of earnings season inhibits investor relation teams’ abilities to communicate transparently about both their current state of affairs and their long term goals and projections.

Based on Fink’s request, we wondered whether investor relations teams are truly communicating more effectively in their longer term reporting situations. Our proprietary communication analytics platform puts us in the unique position of being able to answer questions like this by looking for communication trends across large sets of data. We analyzed the prepared remarks of 3 years’ worth of quarterly earnings calls from S&P 500 companies and measured them against shareholder letters and investor day presentations from the same 3-year period.

We found that Mr. Fink’s analysis was spot on.

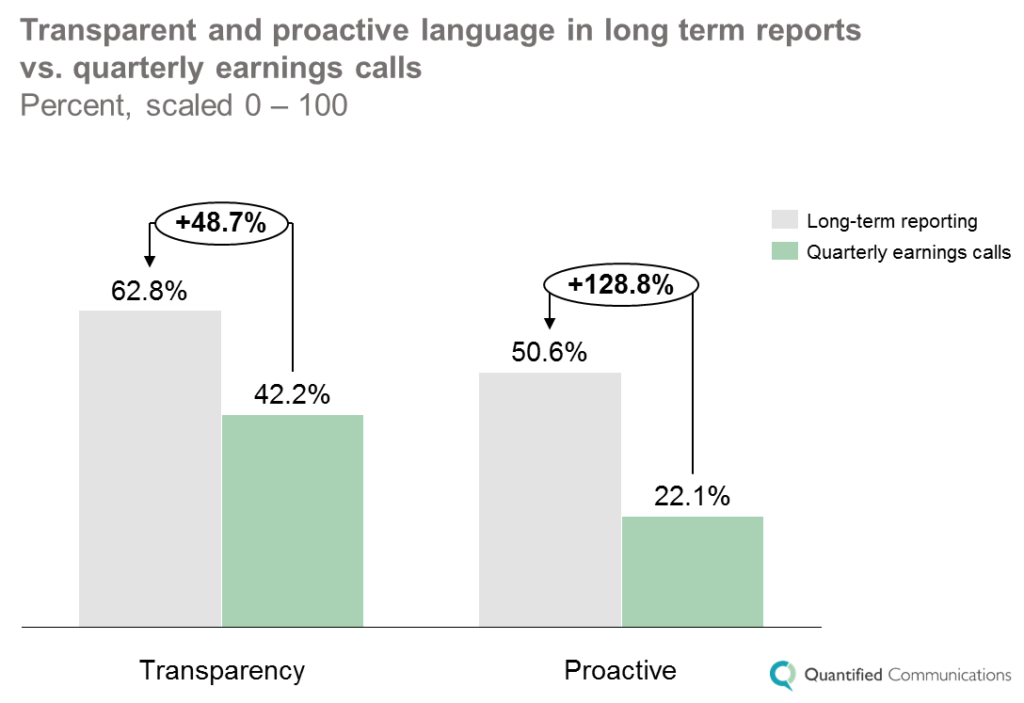

Investor relations teams tend to use 48.8% more transparent language in their long term reporting than in their earnings calls…

“We also believe that companies have an obligation to be open and transparent about their growth plans so that shareholders can evaluate them and companies’ progress in executing on those plans.” -Mr. Fink’s letter to CEOs

According to our analysis, shareholder letters and investor day presentations tend to communicate company status and initiatives much more transparently than the average quarterly earnings call. These longer term reporting events seem to have opened doors for investor relations teams to offer clearly and insightful outlines of their companies’ financial results as well as key initiatives and progress against goals.

…and more than twice as much future-oriented language in their long term reporting than in their earnings calls

We found that, on average, investor relations teams are using 1.29x more proactive language—designed to demonstrate initiative and foresight—in long term reporting events than in their quarterly calls.

The decreased use of future-oriented language in earnings calls is consistent with Mr. Fink’s complaints that so many communications to shareholders are “too often backwards-looking and don’t do enough to articulate management’s vision and plans for the future.”

He requests that investor relations teams orient these communications toward upcoming innovations, plans to remain competitive within their industries and investments in the company’s long term wellbeing.

It’s too soon to tell whether corporations will take Mr. Fink’s advice and move toward eliminating the quarterly earnings call. But our analysis has demonstrated that investor relations teams could very well benefit from revising those quarterly reports with some of the forward-thinking and transparent language found in their shareholder letters and investor days.

To find out how Quantified Communications can help your investor relations team improve your shareholder communication strategy, email us at info@quantifiedcommunications.com.

More on financial communication measurement and data-driven investor relations from Quantified Communications.