Do IPO Videos Work? An Analysis of Snap’s Roadshow Video

As Snap, Inc. prepared for its IPO last month, it bucked old-school roadshow traditions by releasing a highly polished 35-minute IPO video featuring the tech companies’ executives (and a client or two) extolling their virtues and outlining their origin stories and visions.

The video generated plenty of buzz around the company’s next big move but, when March 3 came along and Snap went public, after the expected first day pop, the stock plummeted.

The video generated plenty of buzz around the company’s next big move but, when March 3 came along and Snap went public, after the expected first day pop, the stock plummeted.

In the month following the IPO, the stock price continued to fall for several days before gradually lifting and leveling out. (Interestingly enough, Facebook — the pioneer of the IPO video — saw similar behavior in the market during the first 30 days after going public in 2012.)

We couldn’t help but wonder whether Snap’s video and financial communication strategy had anything to do with its early valuation drop, so we used our communication analytics platform to identify the areas that might have contributed to their rocky start on the market.

We couldn’t help but wonder whether Snap’s video and financial communication strategy had anything to do with its early valuation drop, so we used our communication analytics platform to identify the areas that might have contributed to their rocky start on the market.

We found that, while Snap’s executives’ were highly engaging — a characteristic that made the video fun to watch — they missed an important opportunity to educate investors and the public on their core business results. There was plenty of sizzle, but not as much substance.

Engaging Messaging Made for Entertaining Viewing

It’s easy, when presenting to investors, to get so bogged down in the numbers that we end up delivering a dry recitation of details instead of framing our core message in a more engaging way. Consider, for example, this snippet we wouldn’t be surprised to find in an earnings call:

“The results of the last quarter were caused by cost cutting synergies and improved efficiencies and, therefore, by continuing on this path, we can expect our results to be optimized by approximately 10-15 percent in the coming quarters.”

You’d be hard pressed to warm up to that kind of language, wouldn’t you?

To their credit, Snap executives avoided this trap in their IPO video, using more engaging language than the average executive in an investor or analyst presentation.

We measure engagement by the emotionally charged, sensory language that helps readers visualize the message, feel intimately connected with its outcome, and recall key points after the presentation. These elements are what enable a listener to relay a message to a coworker, friend, or family member after hearing it.

We measure engagement by the emotionally charged, sensory language that helps readers visualize the message, feel intimately connected with its outcome, and recall key points after the presentation. These elements are what enable a listener to relay a message to a coworker, friend, or family member after hearing it.

For example, early in the video, Snap CEO Evan Spiegel illustrated Snapchat’s place in communication history as well as the secret to their success:

“Throughout history people have wanted to communicate in intimate ways. Whether it’s the handwriting on a letter that reveals someone’s personality, or the sound of their voice — I can’t imagine the way that it must have felt on that first phone call when you could hear the other person’s voice in real-time coming through the phone. All that emotion. I think Snapchat really tapped into that human desire to communicate in a way that feels like it’s face to face even if you’re far away. The first time you use it and you can see what someone else is seeing at the same time, from their perspective, that moment makes you feel close.”

Framing his company’s vision with such vivid sensory language helped Spiegel’s audience become involved with the story. When we picture a loved one’s handwriting, or hear a friend’s voice in the context of Snap’s world, we make similar, warm associations to the camera app — and, in turn, we’re more likely to download it or share it after the presentation.

Lack of Core Business Focus May Have Made Snap’s Message Miss the Mark

But warmth and intimacy are hardly the whole story when it comes to convincing investors. While characteristics like engagement are critical in fostering that initial connection with the audience, they can’t carry the day on their own — especially when presenting to analyst and investor audiences who want the bottom line as well as a good story.

Looking for data and facts on the business’ key initiatives and results, the financial audiences wanted to know if Snap was likely to provide a strong return on their investments.

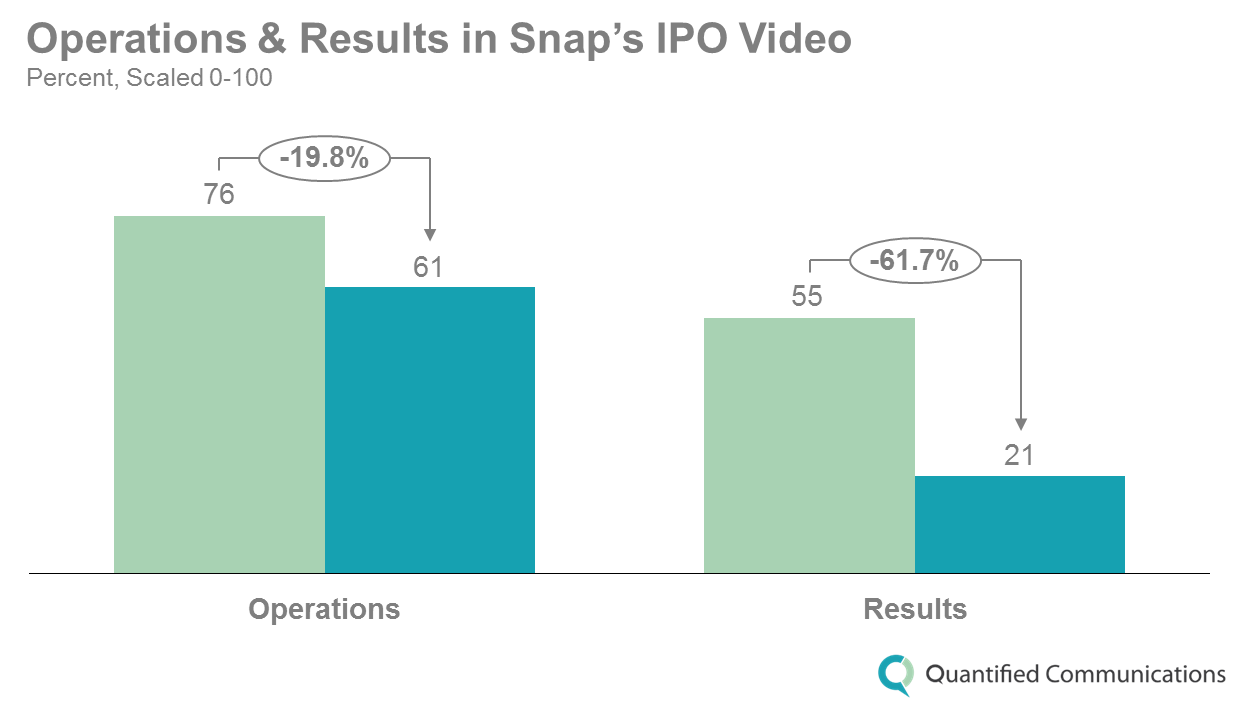

And that’s where Snap dropped the ball: the company’s discussion of both business operations and results fell significantly below the average financial presentation.

As the New York Times noted, “From beginning to end, the pitch video is filled with sunny shots of Venice Beach and framed photos of Snap’s early days.”

As the New York Times noted, “From beginning to end, the pitch video is filled with sunny shots of Venice Beach and framed photos of Snap’s early days.”

And it’s true — the video focused largely on the idyllic beachfront office, company traditions, and corporate culture. While all these colorful details are enticing for potential employees and millennial users, they don’t offer critical investors the details they need to make a confident decision about the company’s valuation.

So Can IPO Videos Be Beneficial?

Unfortunately, with a sample of just two to go on, it’s too soon to tell whether this new approach will take off. On the other hand, we learned an important lesson from Snap’s IPO video. The highly produced nature of these videos gives companies a chance to deliver a truly engaging message, including voices and stories that just don’t fit into a traditional roadshow.

However, like a traditional roadshow — or any other financial presentation — investors are looking for substance along with style. While we can’t make any claims as to cause and effect, we wonder if a more detail-driven video and communication strategy might have led to more positive trend in Snap’s stock price immediately following the IPO.

Interested in learning more about effective financial communication?

Download QC’s free white paper on best practices for Investor Days.