Want investors to fall in love with your CFO?

Fortune recently noted that investors and analysts alike have praised Alphabet’s CFO, Ruth Porat, for her performance on the newly formed holding company’s first earnings call.

Fortune recently noted that investors and analysts alike have praised Alphabet’s CFO, Ruth Porat, for her performance on the newly formed holding company’s first earnings call.

What about her style made her performance so notable? And what traits could other CFOs use to help them have even better discussions with their investors and analysts?

What contributes to making a CFO’s performance a hit with investors?

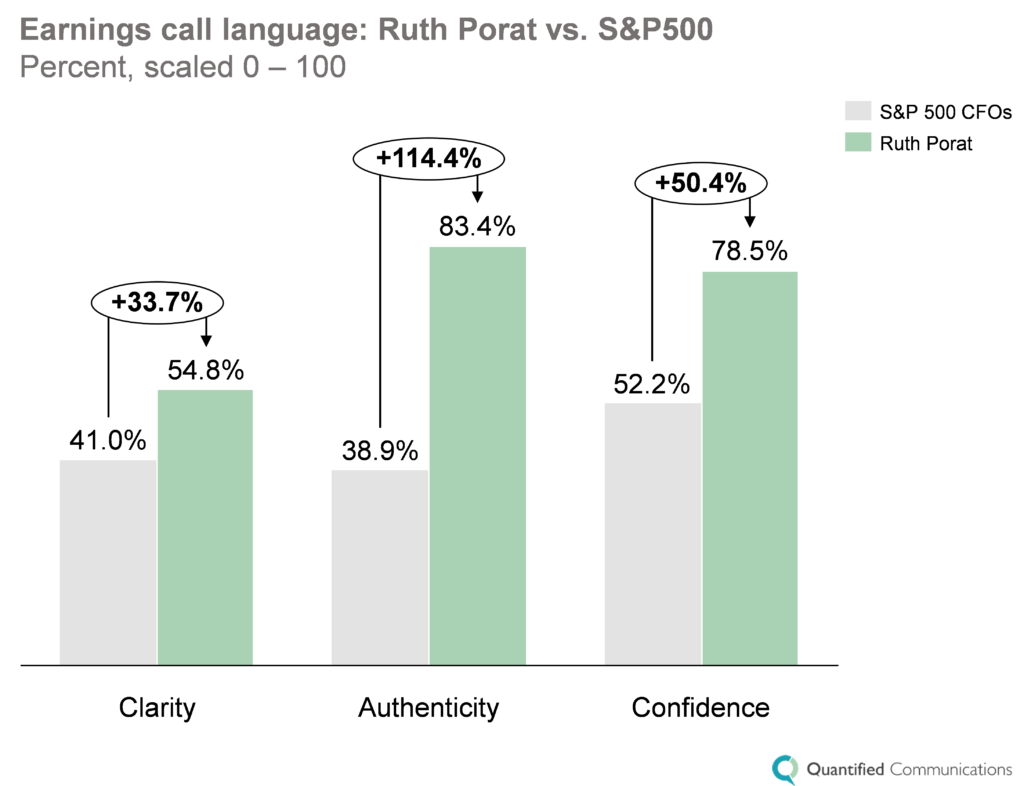

To find out what made Porat’s communications style on Alphabet’s first earnings call so distinctive in investors’ eyes, we used our Quantified Communications analytics platform to evaluate Porat’s language and compare her performance to other S&P 500 CFOs.

Based on our analysis, we found that Porat particularly shined during the Q&A section of the call:

- Clarity: Porat communicated with 33.7% more clarity than other CFOs, supporting Fortune’s assertion that “Porat possesses a rare ability to do something most tech executives, Wall Streeters, and CFOs are horrible at: speak in plain English.”

- Authenticity: Porat communicated with 114.4% more authenticity than other CFOs. Touted by Fortune for bringing a “dose of much-needed transparency to the company,” Porat acted like her authentic self during the Q&A. Though the Alphabet CFO’s performance was particularly notable, it’s common for executives to speak more authentically off script, following the prepared remarks.

- Confident responses: Porat used 50.4% more confident language than her peers. This was rooted in the fact that she shared deep insights, answering “analyst questions with actual substance, a refreshing change from the typical corporate-speak dodges that plague earnings calls,” according to Fortune. For example, Porat stated that “The move to Alphabet gives us the opportunity to provide some greater insight, so you can see the investments we’re doing.”

Interestingly, we found that during both the prepared remarks and the Q&A, Porat spoke with 65.5% less uncertainty than other CFOs—a winning approach in the eyes of investors and analysts.

By focusing on plain English and increased transparency in Alphabet’s earnings announcement, Porat was able to connect with her key audiences when it mattered most. Investors responded positively – in the day following its Q3 2015 earnings call, Alphabet’s stock saw a 7.0% bump.

More on financial communication measurement and data-driven investor relations from Quantified Communications.