Should companies abandon prepared remarks on earnings calls?

There is an ongoing debate over whether companies should offer prepared remarks during quarterly earnings calls. In our experience working with S&P 500 investor relations teams, we have seen a variety of approaches to structuring earnings calls. Some companies such as Netflix, Progressive and Tesla have chosen to pivot away from prepared remarks entirely, an approach supported by one McKinsey senior expert.

With investors seemingly less focused on the numbers on earnings calls and more focused on companies sharing forward-looking strategies, how can companies decide the ideal approach for their specific situations?

When to opt out of prepared remarks

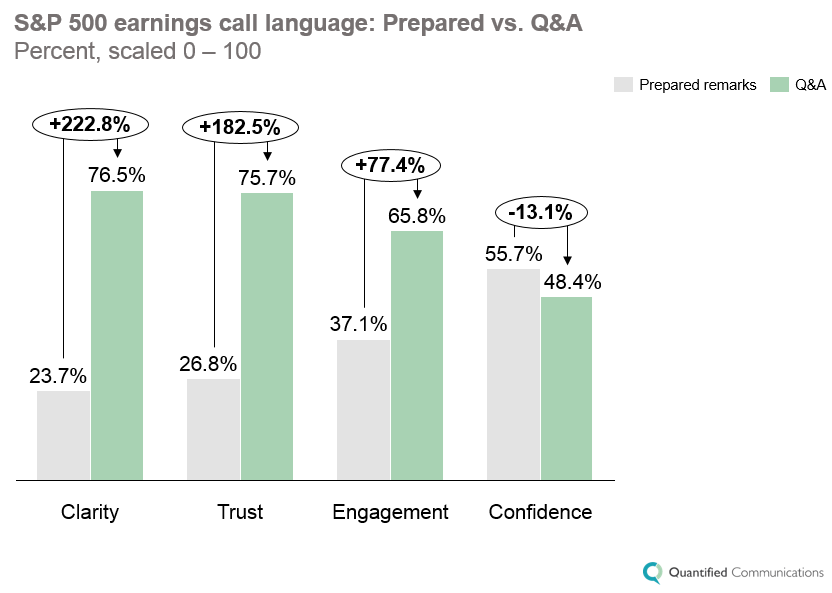

Our research has found that executives typically speak in a more natural tone of voice during the Q&A sections of earnings calls, in part because they are not reading from a script. We can see this most clearly by comparing the level of clarity, engagement and trust in prepared remarks vs Q&A in S&P 500 company earning calls over the last four quarters.

This data, coupled with a situation when your company has a strong and deep relationship with your analysts, suggests that it may make sense to opt out of prepared remarks. What’s more, the average experience level of analysts is decreasing, while the analysts’ coverage is increasing—which means that analysts may be less familiar with your company and industry than ever before.

A time and place for prepared remarks

Assuming that you provide a press release ahead of your call, analysts and investors will have had time to digest the information and prepare high quality, thoughtful questions. Rather than repeat the financial results by rote from the earnings release in the prepared remarks, best-in-class companies use this time to give investors what they are looking for: the “why” behind the “what.”

According to our analyst interviews, management’s candid perspective on the earnings results as well as answering their questions is highly valuable. Further, by providing investors with a deeper dive into the factors that led to this quarter’s performance in the prepared remarks, the investors are able to dedicate their questions in the Q&A session to getting deeper level insights.

Audience before content

Best-in-class speakers consider their audience before creating their content—and this is no different in financial communications. In your post-earnings call backs, ask your investors what structure would be most appealing to them. Earnings calls are an opportunity to have a better dialogue with your investors – don’t be afraid to break from conventions in order to do this.

To learn more about how we can help your team use analytics to evaluate and strengthen your financial communications, contact us at info@quantifiedcommunications.com.