Polycom’s advances in developing countries points to potential growth worldwide in video conferencing

Hello, Mr. Watson. Can You See Me?

By TIERNAN RAY

Is it in our nature to resist technology, or just an accident of where we’re born?

I was put in that contemplative frame of mind by a conversation with Andy Miller, CEO of a company called Polycom (ticker: PLCM), which competes with Cisco Systems (CSCO) and others selling video-conferencing systems. You’ve probably seen a Polycom speaker phone if you’ve been in a conference room in the past decade.

Polycom gets 67% of its revenue not from speaker phones, but from devices that allow video calling, mostly between corporate offices. I asked Miller why it is that nearly 50 years after AT&T (T) promised the “picturephone,” most people in major economies, especially the U.S., resist having video chats with their friends.

Although you can use the Skype chat program to make video calls from one cellphone to another these days, even people much younger than I don’t use that function as much as one might expect. As numerous reports have shown, we’re a nation of texters, pecking away on BlackBerries and sending Facebook and Twitter updates.

Sure enough, it turns out this is one of those technological waves where the developing world has got the developed economies beat, Miller suggests. Polycom gets 24% of its revenue from Asia-Pacific, and so Miller does a lot of traveling: Last year, he toured 37 countries. In India, one of the big emerging markets for Polycom’s technology, most video chatting takes place between individuals and happens on an informal, spur-of-the-moment basis, says Miller.

One thing helping to propel video conferencing in India, and in China, is that local phone companies are more nimble, more flexible, he says. In some Asian markets, phone companies consider video another part of a “bundle” of services, along with phone calling and Internet and TV services.

Then, too, much of the developing world is buying its cellphone service “prepaid,” meaning customers pay a flat fee up-front, and “top-up” their accounts with more money as needed. Miller suggests this phenomenon, as opposed to the monthly bill, prompts phone companies to cook up all sorts of incentives to pull more money from consumers, such as video-calling deals.

In China, where Polycom gets 11% of its revenue, the video phenomenon is more prevalent among bureaucrats than consumers. The phone companies provide video-conferencing facilities to China’s government offices. Maybe it helps to perceive body language when China’s central bankers are mulling whether to boost the value of the renminbi.

But whether statist, like China, or impulsive, like customers of Indian phone companies like Reliance Communications (RCOM.India), emerging economies seem to be finding their way to talking and seeing at the same time more easily than the U.S. and other “advanced nations.”

Polycom’s revenue in Asia-Pacific was up nearly 40% in the first quarter, trumping the 28% growth in Europe, the Middle East and Africa, and the 17% gain in the Americas.

Something is probably happening in China and India on a level deeper than a difference in the structure of the telecommunications business. Something is prompting consumers to grab hold of this particular innovation in a way people haven’t in other parts of the world.

An anthropologist would know better, but my guess is that similar to how text messaging swept Europe and other parts of the world before catching on in the U.S., video calling will eventually conquer whatever our deepest fears are about seeing and being seen when calling.

Apple (AAPL) and others are doing their best to push the matter. Apple’s “FaceTime” video conferencing now connects all of its computers, from iPhone to iPod to iPad to Mac laptops and desktops. But it doesn’t work unless you’re in a WiFi hotspot.

Polycom is hoping to broaden the appeal of video on mobile devices. It’s licensed its technology to tablet-computer makers such as Motorola Mobility (MMI), which sells the “Xoom” tablet computer. In coming months, that software will allow video callers to plug into Polycom equipment already installed in many offices. There’s even a prospect we could see a Polycom-Apple agreement, though Miller is chary on the subject.

Is Polycom’s stock a buy based on this wave? It is a growth company, posting growth of 26% in earnings per share last year, with the expectation of 37% growth this year. On that basis, the stock is pricey at 25 times forward estimates. But obviously on a P/E-to-growth basis, the multiple of 0.7 times is pretty reasonable.

Its stock is up 62% in the past 12 months, so Polycom is hardly undiscovered, but it’s worth keeping an eye on.

Apparently, another thing we don’t know much about here in the developed world is how the rest of the planet is using personal computers. I wrote a week ago that U.S. research firms Gartner and IDC both reported that global personal-computer sales fell between 1% and 3% in the first three months of the year (Tech Trader, “Why PCs Don’t Compute: Mobility Owns the Future,” April 18).

Well, on Tuesday, Intel (INTC), the world’s largest supplier of microprocessors for all those computers, crushed estimates. Intel delivered an additional $1.2 billion in revenue above the $11.7 billion it had estimated back on Jan. 31. The stock promptly jumped 6%.

It was a stunning upset for Wall Street’s bean counters; they have been accustomed to fairly reliable projections by Intel, which generally “guides” analysts close to the final number. Even taking the high end of the range Intel had offered, $12.1 billion, the final number showed an additional $800 million in revenue.

How did they do it? I spoke with IDC analyst Jay Chou following the results. He concedes that although IDC works closely with Intel, and with competitor Advanced Micro Devices(AMD), to get its arms around the market, there are plenty of holes in the prognosticating business. In fact, the market for “white boxes,” machines made by no-name computer assemblers, can be difficult to track reliably, Chou notes.

It’s possible, Chou says, that when IDC releases its final estimate of first-quarter PC sales, on May 11, the number will come out better than he’d initially calculated, based on Intel’s surprise.

But the larger point for Intel, and its stock, is that this is a highly “dynamic” company, if you will. Intel saw revenue for its chips that go into server products rise 32%. That’s proof that Intel has moved beyond being just a PC company.

Anyway you slice it, a dramatic performance by Intel. Its stock deserves better than its P/E multiple of 9 even after last week’s bounce.

Surpassing All

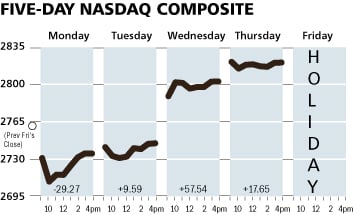

Wireless products helped Apple and Qualcomm earnings top expectations. Intel, too. The Nasdaq Composite ended the four-day week 2% higher, at 2,820.

![[5DAYNAS-0425]](https://quantified.wpengine.com/wp-content/uploads/2021/11/on-as902_5dayna_ns_20110422233507.jpg)