Let’s Be Clear. What can we learn from 3 legendary CEOs’ annual shareholder letters?

At Quantified Communications, we urge clients to focus on clarity in all their executive communications, and annual shareholder letters — notoriously dense documents — are at the top of the list. No matter how crisp the numbers, no matter how good the news, your letter is far less effective if it’s unclear to the investors who read it.

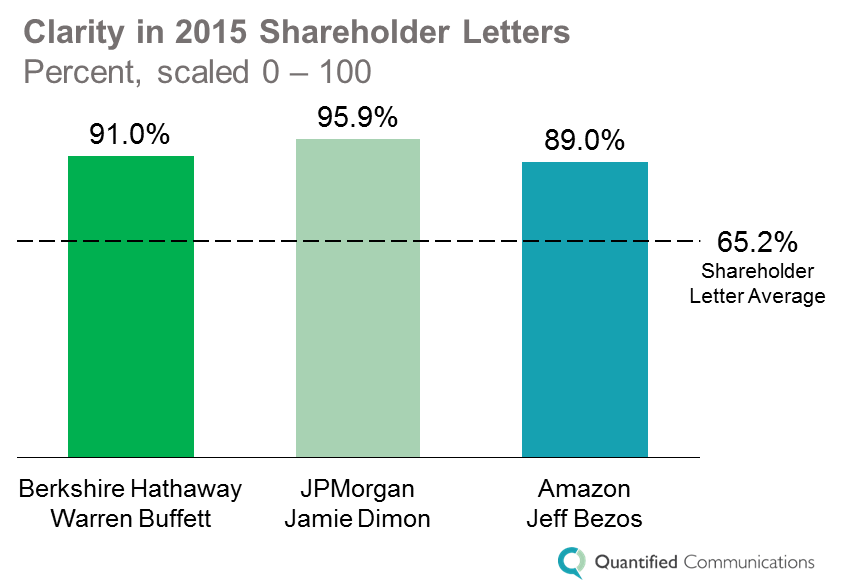

We used our proprietary language analytics platform to measure the clarity of more than 2,000 shareholder letters written by Fortune 500 CEOs, and found that three of the most anticipated 2015 letters raised the bar.

What can we learn from Warren Buffett, Jamie Dimon, and Jeff Bezos?

We use a number of factors to measure clarity, and we always recommend that communicators incorporate a variety of the tactics we’ve found to be effective to ensure their message is being heard. While each of these three letters do follow that advice, we found that each CEO leaned heavily on a different technique to achieve clarity.

We use a number of factors to measure clarity, and we always recommend that communicators incorporate a variety of the tactics we’ve found to be effective to ensure their message is being heard. While each of these three letters do follow that advice, we found that each CEO leaned heavily on a different technique to achieve clarity.

The use of such different but effective approaches makes this trio of annual letters a perfect primer for any executive who’s looking to learn the distinct components of clear communication.

Buffett’s trademark no-nonsense tone leaves readers perfectly clear on his positions.

In a recent article on the importance of candor in executive communications, we cited Warren Buffett as a CEO who consistently communicates with high levels of clarity, enabling employees, investors, and customers to understand his vision and their role in that vision. His 2015 shareholder letter certainly maintains that trend.

“Our equity in Coca-Cola grew from 9.2% to 9.3%, and our interest in American Express increased from 14.8% to 15.6%. In case you think these seemingly small changes aren’t important, consider this math: For the four companies in aggregate, each increase of one percentage point in our ownership raises Berkshires portion of their annual earnings by about $500 million.”

Buffett doesn’t hedge or sugarcoat his points. Instead, he delivers his message in a frank, candid tone that eliminates any doubt in readers’ minds as to where he stands.

Thanks to signposting Jamie Dimon is 5% clearer than the Oracle of Omaha, himself.

As the country continues to climb out of recession, and as the election year inspires politicians to turn up the volume on the debate over big banks’ place on our financial landscape, it’s crucial that these banks communicate in a way that makes their vision and their operations accessible to their audiences.

JP Morgan CEO Jamie Dimon’s 2015 letter indicates he’s heard that message, as he uses language that is 47% clearer than average. Dimon’s clarity comes from his knack for signposting — that is, creating anticipation for what’s to come. Throughout the letter, he foreshadows what the audience can expect to read next:

“Later in this letter, I will also describe what we are doing to strengthen JPMorgan Chase and to help support the entire economy.”

By creating a point-by-point roadmap of his letter, Dimon ensures readers can follow the train of thought and the direction of his message.

Jeff Bezos uses pronouns to guide readers through his letter.

From introducing same day delivery with Prime Now, to supporting third-party sellers through Marketplace, to attracting more than a million customers to AWS, the name of the game for Amazon in 2015 was customer inclusion. And the conversational language in Bezos’ shareholder letter, which is 37% clearer than average, reflects that theme of being in it together.

Bezos uses frequent pronouns — both first and second person — to include readers in the dialogue, helping to ensure they receive the message he aims to send.

“One area where I think we are especially distinctive is failure. I believe we are the best place in the world to fail (we have plenty of practice!), and failure and invention are inseparable twins. To invent you have to experiment, and if you know in advance that it’s going to work, it’s not an experiment.”

Clarity is crucial to just about any communication type, but it’s notoriously difficult to achieve in a shareholder letter.

We know it’s not easy to sum up a year’s worth of financial progress and projections in one easy-to-digest document. But as CEOs sit down to compose their own annual letters, they can look to these three examples for guidance on how to keep their message crystal clear.

To find out how Quantified Communications can use analytics to help ensure your company’s executive communications are best-in-class, email us at info@quantifiedcommunications.com.