How Great Companies Communicate Earnings During a Crisis

There’s no denying the economic fallout of the COVID-19 crisis. With the stock market plummeting at a record pace, events being cancelled across the globe, and small and large businesses shutting their doors for the foreseeable future, unfortunately, it’s a good bet that financial reports for Q1 and Q2—at least—will be concerning for many companies.

While the silver lining is that everyone’s in the same boat and there won’t be any mystery as to why companies have missed estimates this time, leaders will still need to communicate the company’s financial position in a way that encourages investors to stick with them.

Quantified’s research finds that, when it comes to communicating an earnings miss—crisis or not—there are two key goals CFOs and other executives need to keep in mind: maintaining trust and looking toward the future.

Communicating Earnings to Maintain Investor Trust

With so much uncertainty in the world, people are craving clear communication from leaders they can trust, and investors are no exception. If companies want to maintain their favorable financial reputations and keep analysts and investors on their side, their number-one goal should be demonstrating that the leadership can be trusted. That is, they’re committed to transparency around what’s gone wrong, what challenges they’re facing, and what they’re doing to get back on track.

A recent CFA Institute survey of analysts and investors found that a lack of transparency in financial reporting leads to loss of investor trust and has negative implications on their willingness to invest.

Our analysis of nearly 400 earnings calls from the S&P 500 found that companies communicating missed estimates tend to use 6.3% less trustworthy language than companies who met or beat estimates.

Trustworthy language refers to language that indicates speakers are being honest with their audience, and we measure it by looking for patterns of both honest and deceptive communication.

While, frankly, we’d like to see companies building trust more successfully no matter where their earnings numbers fall, in times of missed estimates, financial uncertainty, and, yes, global pandemic, that trustworthy language is more important than ever.

When it comes to earnings calls, our research identifies four key factors executives should focus on, especially when the numbers aren’t good.

- Own the results:To take responsibility for the earnings miss and display ownership of the results, use more first-person pronouns and active voice. Of course, it will be easy (and even forgivable) to let COVID-19 take the blame this time around, but passing the buck won’t do much to ease investors’ concerns. Were you hit harder than you should’ve been because you didn’t have enough reserves built up, or you didn’t have a crisis plan at the ready? Take responsibility for any lessons learned, and then focus on how you’re going to be sure you’re ready next time.

- Minimize negative language:Negative language can be correlated with guilt about the topic being discussed. It is important to acknowledge what went wrong, but dwelling on the downsides can have a negative impact on overall perception. Rather than lingering over the “really terrible obstacles” or “truly horrible surprises” that led to “dismal result,” keep it measured, and then move on. Because while acknowledging the bad is important, it’s equally important—if not more so—to shift the focus to what you’re doing to correct it, using positive language to show optimism for the future. (More on that in a moment.)

- Be transparent:So, while it’s important to focus on the positive, don’t try to spin bad news to make it look good. Acknowledge the miss, and be candid about the challenges you anticipate moving forward. According to research conducted by Stanford’s Rock Center for Corporate Governance, when CEOs and CFOs use language that follows traditionally deceptive patterns on earnings calls, that creates a 4-6 percent increase in likelihood of an earnings restatement. “Deceptive language” doesn’t necessarily mean a speaker is lying (and usually, it doesn’t), but it refers to language that is consistent with the way dishonest speakers tend to speak. This includes using third-person pronouns (they, it) and passive voice (“mistakes were made”) to skirt responsibility. It also includes an inability (or unwillingness) to offer “why” and “how” insights to support your message, and, as mentioned, overly emotional (specifically negative) language. Avoid these patterns in favor of straightforward, insightful communication. Your shareholders will appreciate your honesty, and the credibility of your management team will remain secure.

- Be prepared:Make sure that all executives with a role in communicating the bad news are aligned on messaging and understand how to customize their talking points to each of the constituents on the call.

Look Toward the Future

Like the folks sitting at home worrying about their loved ones, losing income, watching their retirement accounts deplete, and hurting from lack of social interaction, investors are looking for assurance that it will be okay.

While it’s important to be candid about what’s gone wrong, dwelling on the negative doesn’t do anybody any good. So, once you’ve done the hard work of acknowledging the miss, taking responsibility for shortcomings and mistakes on the part of the company, and outlining the challenges you anticipate facing down the road, it’s time to share your plan to turn things around.

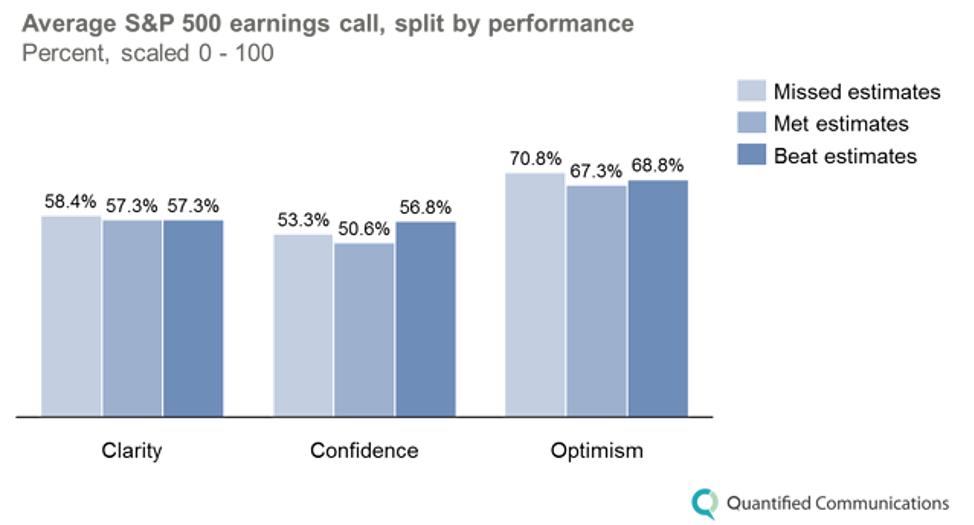

We recommend communicating with three goals in mind: clarity, confidence, and optimism.

To demonstrate the importance of these linguistics traits, we analyzed the language S&P 500 companies used in their earnings relative to performance results. We found that in general, companies communicate in the same way whether they miss, meet, or beat analyst estimates.

We’re not asking executives to paint the future with rose-colored glasses or be blindly optimistic, but corporate leaders do need to ensure investors that there’s light at the end of the tunnel—or, at least, a plan to find it. What initiatives are you beginning to win back customers? What is the timeframe for reopening stores? How have you adjusted your financial goals for the year, and what concrete steps are you taking to ensure you meet them?

Executives will want to continue leaning in to trust-building language here as they focus on the future, demonstrating to investors and analysts that the future of the business is in good hands.

COVID-19 has turned the world upside down, and effective leadership communication is more crucial now than ever. The good news is that, when it comes to earnings, the numbers aren’t everything. What you say and how you say it matters. Investors, like everyone else, are looking to support leaders they can trust, and who demonstrate that they’re working ceaselessly and thoughtfully to pull through the crisis and into a new normal.